qTokens and Early Exit

qTokens

After you've lent your tokens, you may redeem for your full principal plus interest once the Market expires. It is important to understand how qTokens work, which are the units for redemption.

Each Market has an associated qToken, which is minted to a user when they lend to the Market. qTokens represent the full principal plus interest amount that the user will earn when the Market matures. You may think of qTokens as a receipt that you have deposited funds and indicates how much you can receive at the end of the loan.

The advantage of qTokens is that they allow for greater capital allocation efficiency. Without them, the user would have to wait for the return of their funds and interest. However, qTokens help track the value of the future cash flow. More importantly, they are also the mechanism that allows users to Exit Early from their loans.

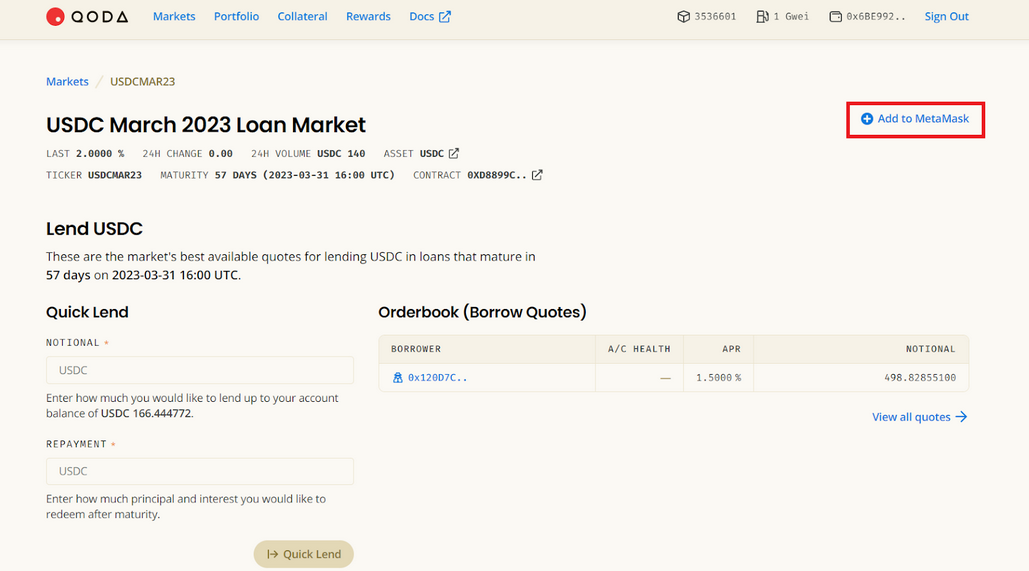

To see the qTokens associated with specific market, click on the +Add to Metamask button on the right.

Add qToken to Metamask

After you've successfully lent to the Market, the protocol will automatically mint qTokens to your wallet. In Metamask, it will look something like this:

qTokens in Metamask

Early Exit

One exciting feature of Qonstant is that it allows you to Exit Early from loans. So just because you have entered into a 1-year loan, it does not necessarily mean you have to wait one year to get back your principal plus interest.

Qonstant fundamentally treats Lending and Borrowing as inverse functions. Therefore, if you've lent to a Market, you can reverse it anytime by borrowing the equivalent amount (and vice versa).

Example. Suppose on 1 January 2023, a user has 0.1 BTC.

Date: 01/01/2023

BTC Balance: 0.1

qBTCDEC23 Balance: 0

They want to lend 0.1 BTC at 10% APR for 1 year via the BTCDEC23 Market. They will immediately receive 0.11 qBTCDEC23 qTokens (initial amount + interest).

Date: 0/01/2023

BTC Balance: 0

qBTCDEC23 Balance: 0.11

Six months later, on 30 June 2023, the user wants to cash out half of their BTC. They can do this by borrowing 0.05 BTC from BTCDEC23 market. Lets say the APR is 10% again. Note that a user will to pay 10% APR on this for the remaining 6 months (so roughly 5% in total):

Date: 30/06/2023

BTC Balance: 0.05

qBTCDEC23 Balance: 0.11 - 0.05*(1 + 10% / 2) = 0.0575

The most important thing here is that the amount of this debt will be deducted from the existing qTokens balance, and the user's qTokens are instantly converted back into the underlying BTC. Suppose they hold on the remaining qBTCDEC23 qTokens until the Market expires. The final balance will be:

Date: 12/31/2023

BTC Balance: 0.1075

qBTCDEC22 Balance: 0

Through qTokens, users have the flexibility to exit open positions early even when the Market has not expired yet!